10k USD

Average Startup Costs

Entity Management

On-shore is the new Offshore

As consultants specialized in international entity management located in Curaçao, we’re proud to offer our services to help businesses of all sizes navigate the complexities of local regulations. Our team of experienced professionals are here to provide a full range of domiciliation and management services, from setting up a registered office to providing corporate secretary services, registered and process agents and more. With our help, you can ensure your venture is fully compliant with local regulations and make sure your international operations hit the ground running.

Requirements to Start a Business in Curaçao

Curaçao introduced the Open Hands program not long ago as a way to entice foreign investment. Under this program, foreign investors can form companies in Curaçao similarly to local ones.

Here are the steps one needs to follow in order to register a company in Curaçao:

- Decide on the type of company that you want to register. There are several types of companies available in Curaçao. (we shall discuss all below)

- Complete the incorporation documents.

- Send the documents to the Curaçao Chamber of Commerce and Industry for registration.

Types of Companies That Can Be Registered in Curaçao

From the perspective of structure, Curacao offers businesses similar to that of the Netherlands. Overseas investors can choose from a variety of business structures:

- Public Limited Liability Company (NV)

- Private Limited Liability Company (BV)

- The Foundation

- The Private Foundation (also known as SPF or Stichting Particulier Fonds)

- Public Partnerships

- Sole Proprietorship

Of these, a private limited company is the most sought-after option. You can rely on Van Holland Curaçao experts for assistance in choosing a company and setting up your business in Curaçao. We can also help you identify the best entry points into the market. Our team specializes in helping you find the best solutions for your business concepts and planned activities.

Starting a business in Curaçao will require you to comply with many different rules and regulations, as well as submit many applications for various permits.

Types of Companies That Can Be Registered in Curaçao

1) Public Limited Liability Company (NV)

NV, in Dutch: Naamloze Vennootschap, is a Public Limited Liability Company. The company can be created by one or more natural or legal persons. Upon incorporation, the charter capital shall be at least AWG 50,000, of which 20% must be paid upfront. However, for certain types of activities, a higher amount of chartered capital may be required.

Shareholders are also limited to the number of their contributions. Shares of the corporate entity are eligible for public offering and may involve additional financial resources.

2) Private Limited Liability Company (BV)

BV, also known as Besloten Vennootschap, is a Private Limited Liability Company. Because of its flexibility, this corporation form is very common. Private limited-liability companies are similar to NV.

The main features of BV include

- A zero-capital requirement.

- Individuals and legal entities may form the board, and one of them may be a resident.

- One share is the minimum requirement.

- The ministry of justice does not have to approve the organization before it can operate.

- Shareholders are the managing body, and the managing director is not required to be appointed.

- Issues are exclusively made by registered shares, and maintaining a shareholders’ register is a mandatory process.

The differences between the BV and the NV are:

- BVs have registered share capital only, while NVs have only common shares.

- A BV’s shares may only be transferred under the law.

- For the “large” NV, there is no distinct financial regime.

- BVs are the only companies capable of being “managed by their shareholders”.

- BV shareholders’ meetings are subject to fewer restrictions than NV shareholders’ meetings.

3) Public Partnership

Public Partnerships are limited partnerships, which distinguish between the general partners and limited partners. The managing partners or general partners are responsible for managing the Public Partnership’s affairs and acting on its behalf.

However, unlike a general partner, the limited partner contributes a fixed amount of money to the partnership. His responsibility is restricted to that amount.

It is prohibited for limited partners to manage public partnership affairs directly, but they may act as the general partners’ “attorney in fact”.

4) Sole Proprietorship

Sole proprietorship (in Dutch: eenmanszaak) is a business structure where the business’s assets do not differ from the assets of the individual. Under such a structure, the business owner is responsible for all company obligations.

If an international individual wish to set up a sole proprietorship, a business license is required. In a proprietorship, income and losses are filed on the owner’s individual tax return.

5) The Foundation

Traditionally, foundations (in Dutch: stichtings) are established to support charitable causes. The foundation is often used to hold legal title to assets that are owned by others economically. In addition to acting as a trustee or custodian, a foundation can also invest, manage and administrate assets for other individuals or organizations.

One of the major differences between a corporation and a foundation is that a foundation does not have members or shareholders, nor does its capital have shares.

6) Private Foundation (Stichting Particulier Fonds)

A private foundation, also known as SPF or Stichting Particulier Fonds, is a corporate entity organized according to Curaçao’s laws.

In Curaçao, private foundations are established through the execution of a legal document. Typically, a Stichting Particulier Fonds is utilized for the management and protection of assets of its beneficiaries, including shares of other real estate, entities, royalties, and deposits.

The Chamber of Commerce of Curaçao maintains a registry of private foundations.

According to the foundation’s bylaws, the founder has certain rights. These rights can be passed either by a private or public deed. The rules also specify which people have access to the foundation’s funds.

The beneficiary of a private foundation can remain secret as long as a trusted agency is selected as its director. Curaçao law requires trust agencies to protect the identities of their beneficiaries.

Curaçao’s Top Investment Industries

The economy of Curaçao offers investment opportunities in multiple sectors. Aside from tourism, which is the island’s main industry, there are also several other good investment opportunities, such as:

- Manufacturing

- Financial

- Technology

- Logistics

- Renewable energy

- Creative industries

Moreover, Curacao is one of the most developed transportation hubs in the region, serving as a major air and shipping transportation hub.

Tax Incentives Abound in Curaçao

Most foreign investors want to know how taxation works in the country where they want to open a business. Here’s what Curaçao has to offer:

- Investment incentives, such as exemptions from foreign income taxes

- Investment allowances

- Trade-related tax incentives

- A free-zone tax system

- One of the lowest VAT levels in the world – 6%

Generally, there is no withholding tax on certain incomes that are repatriated.

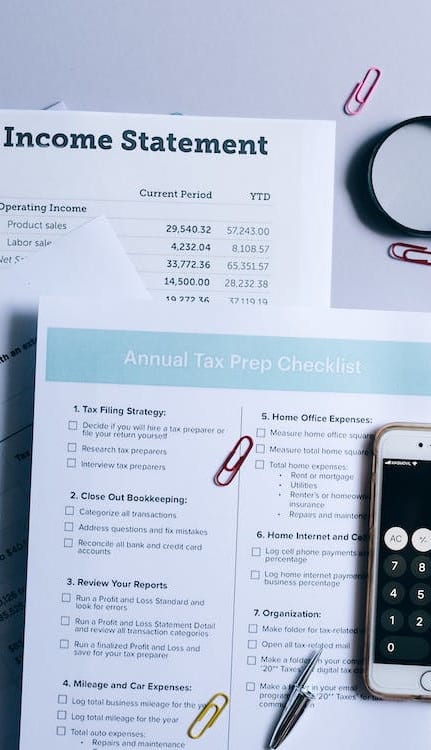

List of Required Documents for Company Formation Curaçao

The following legal documentation is required to set up your company in Curacao:

- A true certified copy of your passport

- A true certified copy of your ID card

- A letter of reference from a trustworthy bank

- A letter of recommendation signed by either a licensed attorney or an accountant

- As proof of current residence, a certified or an original true copy of a current residence certificate or similar document.

- An Original Certificate of Funds

- A copy of the Proof of No Criminal Record

- A recent Curriculum Vitae

- A copy of an official document that confirms the shareholder’s TIN (Tax Identification Number) and the issuer.

What is your best business option in Curaçao?

That’s where Van Holland Curaçao comes in. Starting a business in Curaçao will require you to comply with many different rules and regulations, as well as submit many applications for various permits.

Certainly, you can conduct export research using Google, and you will find a lot of information. But you need a good start, and that means finding partners and supporters in Curaçao.

What can you do to make sure that the business option you have chosen is going to work out?

Van Holland Group assists companies in conducting export research in Curaçao and finding contacts in the right international network. Invest in your success with a trustworthy and reliable partner who is dedicated to your success.

Talk to our team today about company formation and entity management in Curaçao based on your needs.

Pricing Overview

“Transparency in Action: Simplifying Your Experience with All-In Rates”

Our commitment to transparency is unwavering, and that’s why we’ve embraced the concept of All-In rates. With us, you’ll always have a clear understanding of where you stand. That’s why we proudly display all our prices online, ensuring you have full visibility into our offerings.

Business HUB Curaçao

Easy Access to European and US Markets

Due to its status as part of the Netherlands, Curaçao offers you favorable fiscal and legal conditions for entering Europe and the United States.

Office Support Curaçao

Front- and back-office business support

This refers to different business operations within a company. The activities that drive revenue and customer interaction fall into the front office.

What is the best solution for you?

We are happy to help you with personal advice.

- Contact our team by phone (+5999) 515 5651

- Or email to: info@vanhollandcuracao.com